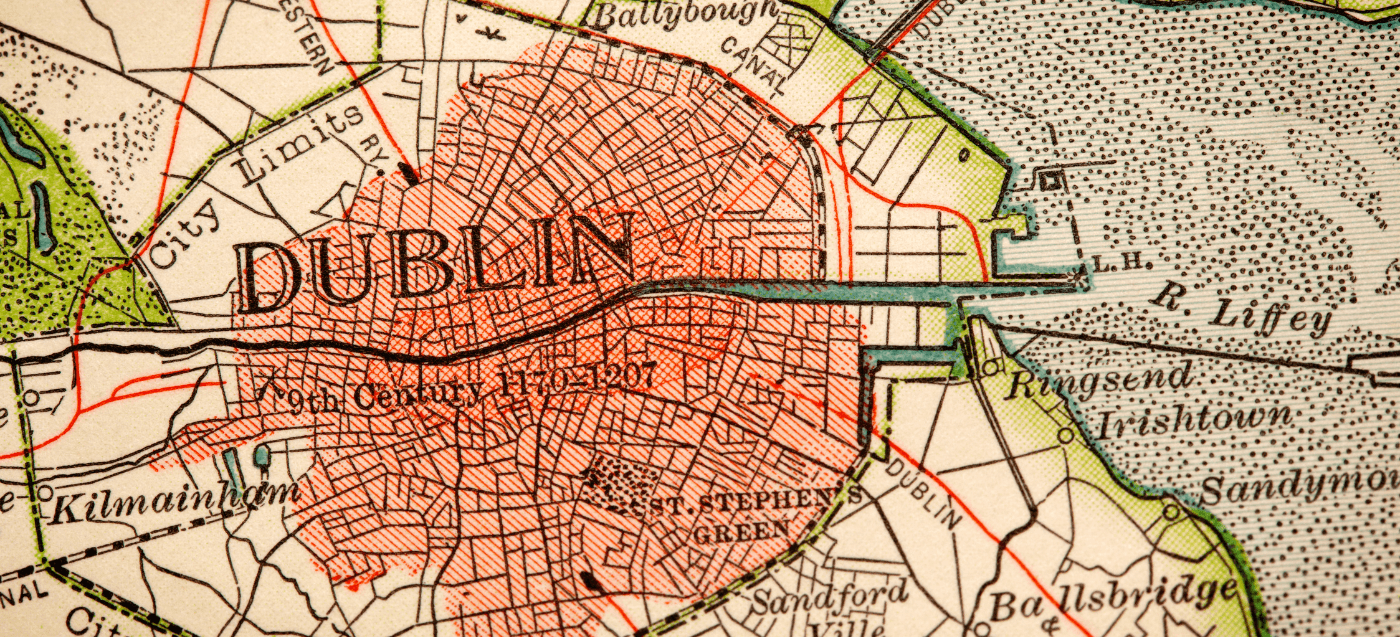

Is Ireland Your Gateway to EU Growth in 2026?

One of the many reverberations of the 2020 British exit from the EU – alongside worker shortages and longer airport queues – has been its impact on international trade. Expanding into the EU is no longer a simple process for UK firms, with 57% reporting a decline in EU trade since Brexit came into effect. What was once a straightforward process has now become a labyrinth of compliance issues, from new VAT obligations to stricter customs and employment regulations.

In this new landscape, however, Ireland could be your gateway to the EU single market. Through our partnership with ETL Ireland, Fiander ETL offers a swift, compliant, and supported route to expansion.

How Ireland Could Be Your Answer

For UK businesses seeking to maintain their presence in the EU, but facing VAT registrations, new customs procedures, and employment law disparities, Ireland can offer a uniquely strategic advantage. As the only English-speaking country in the EU and situated so close to the UK, it can seem like the ideal base for EU operations, but expert support can still be crucial for navigating what remains a pretty complicated process. With coordinated assistance from Fiander ETL and ETL Ireland, firms can avoid common slip-ups and build a structure that’s fully compliant from day one.

How Fiander ETL Can Help

Without specialist guidance, you can risk 6-12-month delays before even starting to trade, costly VAT and customs penalties, or even losing EU market shares to competitors. Fiander ETL can help you avoid all of this while also guiding you through each stage of expansion effectively and sustainably.

Our services include:

- Strategic planning and entity setup

- Tax, VAT and compliance regulation

- Payroll and HR implementation

- Ongoing advisory and growth support

A Collaborative Approach

Our partnership with ETL Ireland means we can support seamless collaboration between your Irish and UK bases, ensuring continuity across the sea and letting you focus on growth without any barriers.Once making the move, a typical UK company is expected to face immediate hurdles with EU VAT registration, customs declarations, and cross-border staffing; however, when working with Fiander ETL and ETL Ireland, you could establish an Irish subsidiary within weeks, complete with compliant payroll and VAT structures.

Looking Ahead

As frameworks like these continue to evolve, expert guidance is increasingly valuable to businesses looking to cross borders. New tax, customs, and employment regulations will continue to surprise us, but your contingency plan doesn’t have to. Working with Fiander ETL and ETL Ireland ensures your business remains proactive, compliant and ahead of the change.