Specialist Advice on Complex Business Tax Matters

Andrew is Director of Corporate Tax at Fiander ETL, leading the firm’s business tax team. He advises clients on a wide range of corporate tax issues, from capital allowances and R&D tax relief through to VAT, payroll, and stamp taxes, providing clear and practical guidance tailored to each client’s needs.

Andrew joined Fiander ETL in 2012, having trained at a Big Four firm before moving into industry. He spent several years with blue-chip companies before returning to practice, bringing with him valuable insight into how businesses operate and the challenges they face. His combined experience across practice and industry enables him to deliver pragmatic solutions to both everyday tax matters and more complex issues.

As a member of the Chartered Institute of Taxation (CTA), Andrew also contributes to the wider development of UK tax policy. He sits on several of the Institute’s technical committees and regularly engages with HMRC and the Treasury on emerging issues and legislative changes.

Specialist Areas

- Corporate & Business Tax

- R&D Tax Relief & Capital Allowances

- VAT, Payroll & Stamp Taxes

- Tax Policy & Technical Committees

- Multi-Sector Business Tax Advisory

Our latest

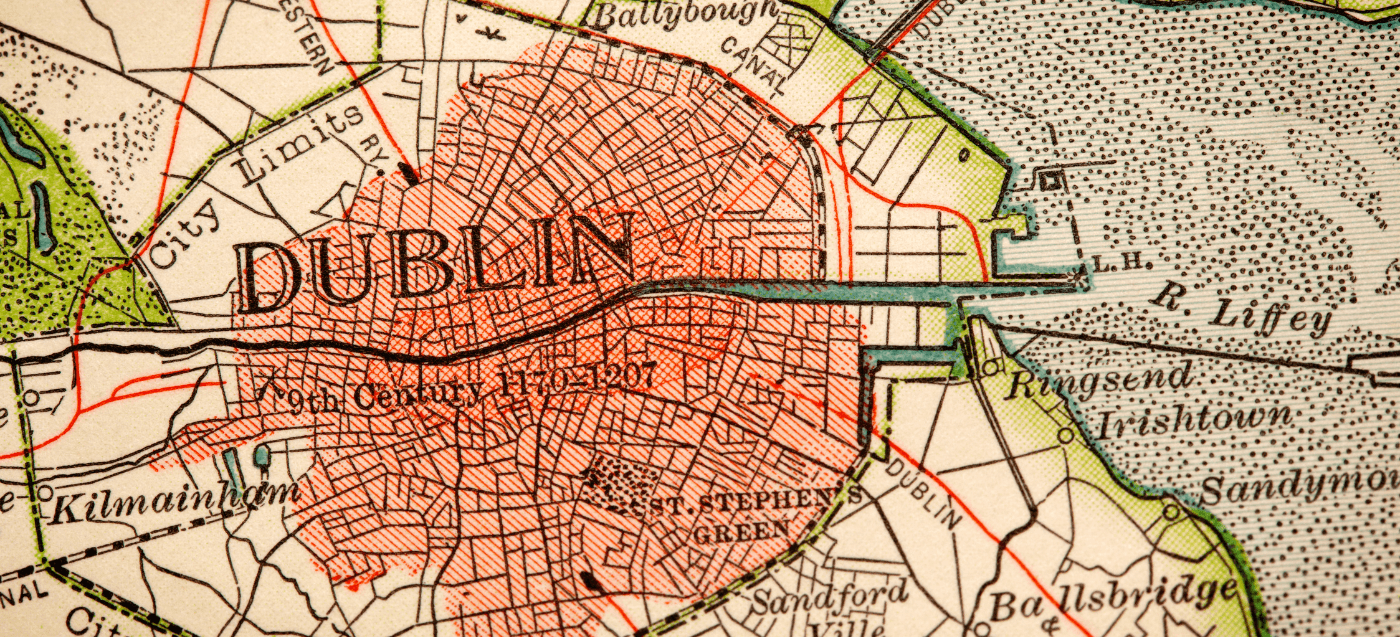

Is Ireland Your Gateway to EU Growth in 2026?

2026 is redefining EU market entry. As regulations tighten and cross-border rules evolve, Ireland is increasingly emerging as the preferred gateway for UK companies seeking stabili

Advisor Spotlight: Ciaran Simpkin

FRS 102 updates 2026 introduce major changes to UK GAAP, including a new five-step revenue recognition model and updated lease accounting rules. Learn how these changes impact fina

Autumn Budget 2025

Explore the Autumn 2025 Budget changes affecting taxes, employment, pensions, and business incentives. Fiander ETL helps UK and international clients navigate planning, growth, and

Proudly Supporting the Crowning Glory Campaign

Fiander Tovell, a leading independent accountancy and advisory firm in Southampton, has announced that it will rebrand as Fiander ETL this autumn.

A New Era for Fiander ETL

Fiander Tovell, a leading independent accountancy and advisory firm in Southampton, has announced that it will rebrand as Fiander ETL this autumn.

FRS 102 Updates 2026

FRS 102 updates 2026 introduce major changes to UK GAAP, including a new five-step revenue recognition model and updated lease accounting rules. Learn how these changes impact fina

July Business Update

July Business Update - In this edition, we share some upcoming apprentice initiatives and the latest happenings within the Fiander Tovell team.

Deal Advisor Spotlight: Helen Holman

With over 20 years of experience, Helen Holman is an Associate Director working in Fiander Tovell’s Deal Advisory team. Her expertise lies in the world of corporate finance, advi

Corporate Advisor Spotlight: Adam Buse

Adam Buse leads the Corporate team at Fiander Tovell, bringing over 13 years of practice experience as a Chartered Accountant. He works across a diverse range of sectors including